Google & Meta Update

A short update for both companies

Alphabet Recommendation: Hold

Upside: (1) Anthropic & SpaceX IPO will artificially inflate Google’s EPS, potentially driving up the stock price further. (2) Gemini continued innovation and market share gains from OpenAI.

Potential caveat: (1) Gemini new ads could be margin dilutive… short term positive.

Downside:

Gemini ads will be a new ad tier on its own, new ad placement (e.g. Banners, Search, Display)

Advertisers use Performance Max on Google, giving Google to gain full control.

Companies can opt in, or opt out of Gemini ads. When Google deems that Gemini ads are suitable, they will show their ads on Gemini.

Gemini ads will be margin dilutive, but given Gemini’s cash burning nature today, an additional stream of revenue and a potential ad inventory expansion (ad inventory is mostly capped now) via Gemini ads is overall a positive, as it allows Google to defend and expand its TAM against other AI competitors. Share gains have continued, with the improvement of Gemini.

Bear case: AI Chatbot searches cost 10x more than a traditional Google Search

AI Chatbots now cost much more than Google search. The key metric to look out for would be to check whether Google Search’s market share is going down. If so, economics for the firm will likely worsen, even if Gemini keeps improving.

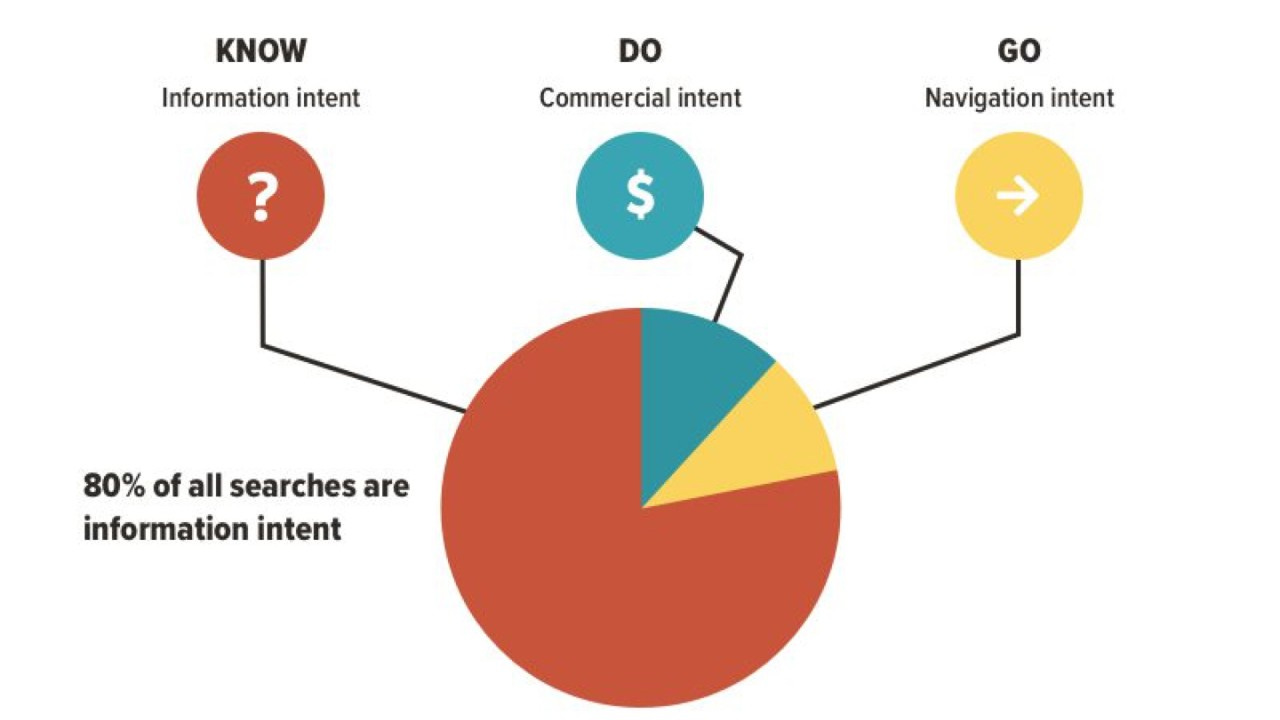

A potential TAM unlocking for Google: Google’s informational searches make up 50-80% of total searches, these searches are zero revenue searches. Concurrently, these AI searches are normally for informational searches. Google might be able to turn these informational searches into extra revenue for the firm.

Gemini also allows TAM expansion for agentic searches: “Plan a holiday for me”. Conversation will allow for greater conversion of consumers. Projected 14% greater conversion for AI searches.

Further potential upside for Gemini: TPUs now lower cost per query by up to 70%, and Gemini’s cost per query is significantly lower than OpenAI’s. Gemini’s transition from margin dilutive to net profit accretive. Gemini’s cost will still be higher than a traditional search, with lesser ads per query. But the bet will be on Gemini’s ability to provide higher conversions through a 10 minute conversation on the AI chatbot.

RPQ= (Ad Load × CTR) × CPC

Currently, CTR is 14% higher at the same CPC. CPC will likely be higher for AI Gemini ads, so Ad load has room to fall.

In summary: positive short-to-medium term. Long-term profitability depends on Google sustaining search share, lowering AI inference costs, and structurally increasing revenue per AI query.

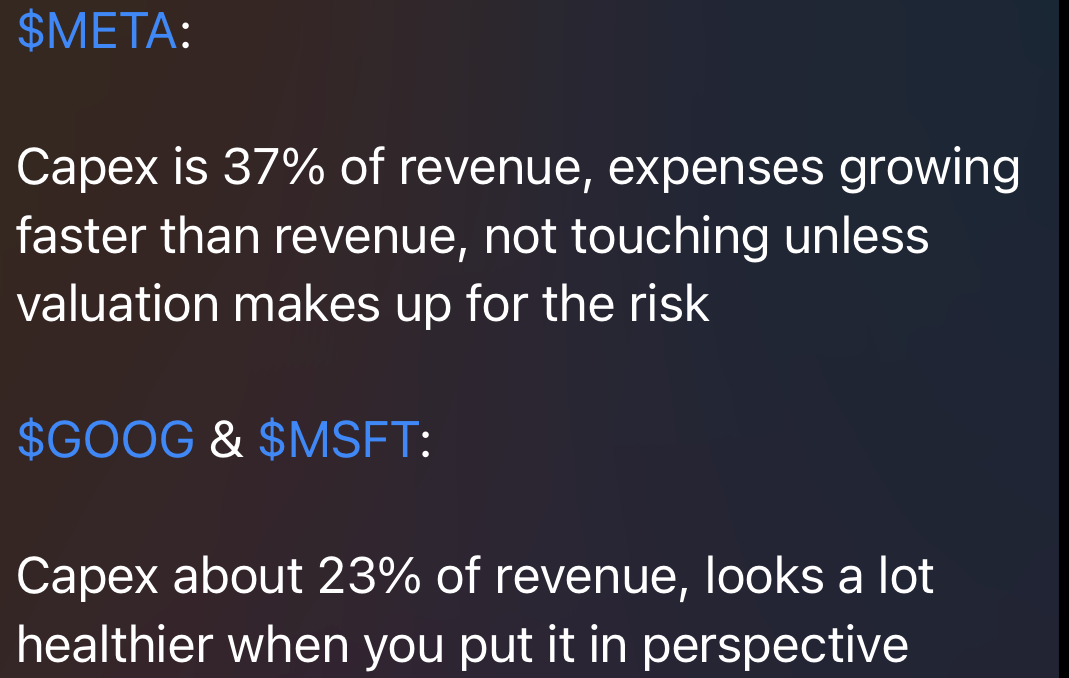

Meta Recommendation: BuyUpside: (1) Full AI Ad build out (2) Potential monetisable revenue streams, whatsapp and threads (3) Undervaluation relative to peers (4) Downside protection for capex spend with GPU fungibility.

Downside: (1) Excessive capex spend and potential D&A hitting bottom line (2) Irresponsible spending by management on “talent” (3) Overcapacity signal

Upside:

On the AI Ad buildout, Meta’s primary audience are the small businesses in the US, with 90% of advertisers from them. Meta’s new AI Advantage+ was launched in November 2025, and will allow advertisers the default option to create ads with Meta Llama 4. Results show 9-12% reduction in Cost Per Action (CPA), and further lowers the barriers to entry for ecommerce stores online, driving volumes and incremental revenue. This is Meta’s way of directly monetising their AI spend into these LLMs, unlike other AI companies. This creates stickiness, no other AI company is doing this with their ads.

Potential monetisable revenue streams include Whatsapp and Threads. Whatsapp thesis is very simple, the company has been building an ecosystem between Whatsapp, FB and IG, allowing users to lead customers from one platform to another. ARPU for Whatsapp is significantly lower than peers, around $1/user (from 10K, revenue/MAU). Telegram is double of that, Line and Wechat are miles ahead. This represents an untapped segment for Meta.

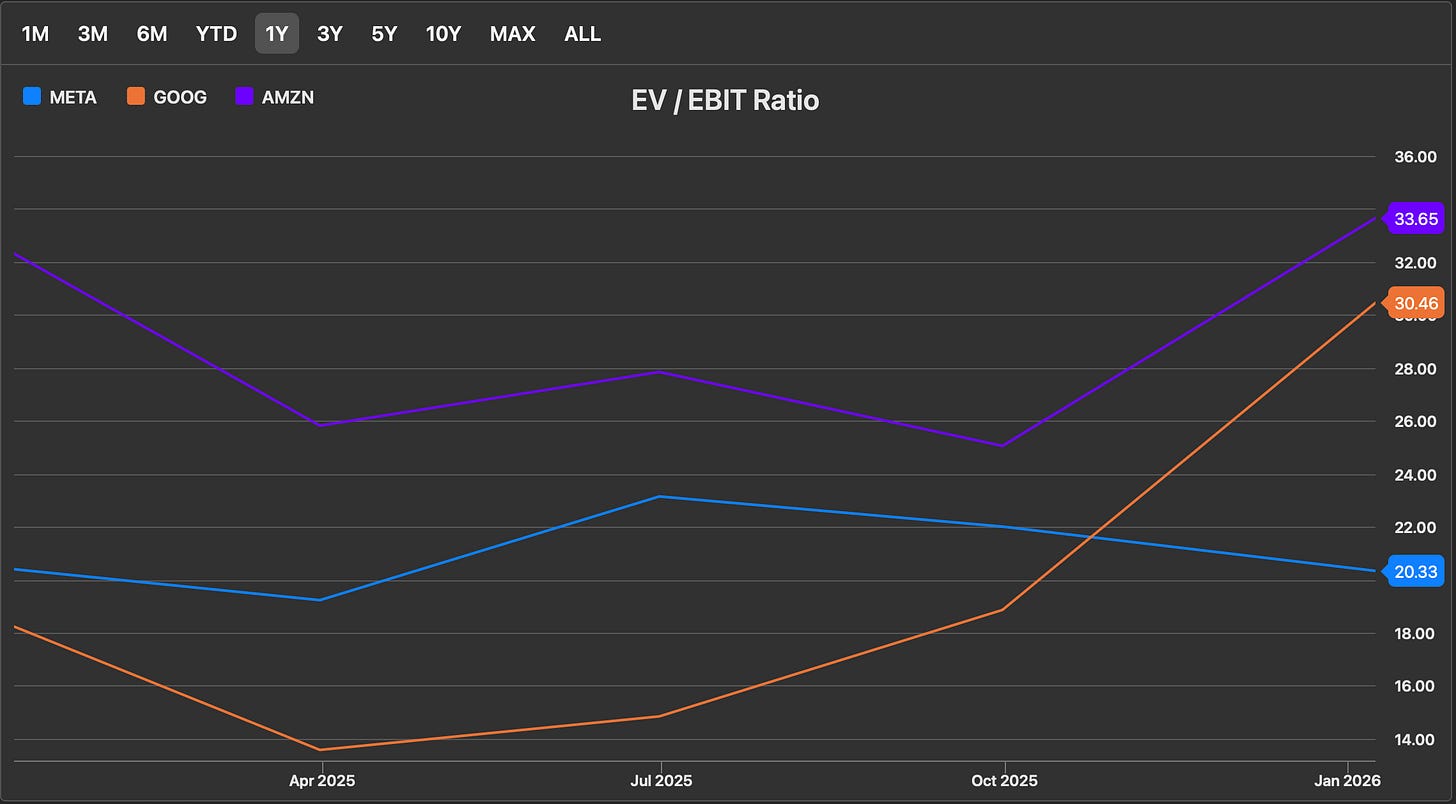

Undervaluation is pronounced, at a 20x EV/EBIT. Google is at 30x, Amazon at 33x.

GPU fungibility: Management has said that it is not worried about overbuilding, and with all of the spend used for the core business (20-30% for LLM, 20% for infra, 50% for training for advantage+) GPU fungibility refers to the ability for the company to pivot its chips away for different use cases (recommendations vs genAI). Marginally bear case would be if internal demand drives up and they start selling APIs (renting the brain of the LLM), which they are planning to.

Downside:

Excessive Capex spend: Capex to Revenue ratio is the highest for Meta. Capex will lead to D&A, leading to bottom line pressures. Key thing to look out for is revenue growth, once revenue growth slows, and D&A growth catches up, margin pressures will come.

Irresponsible spending by management: High SBC hitting bottom line, compensation with hires in 2025 will hit margins in the near term.

Overcapacity signal: Management previously said that when overcapacity comes for utility cycles, the company will try monetising through APIs, which they are planning to for Llama 5, since it is closed source. That suggests overcapacity, one thing to look out for, especially with continued acceleration of Capex. If Llama 5’s performance is not up there with Gemini and OpenAI, API usage will fall, and overcapacity costs will not close. Key metric to look out for is pricing for APIs, vs OpenAI and Google.

Short term story will be dependent on Llama 5’s performance (whether or not it is State-of-the-Art: good at everything) , long term performance will be dependent on TAM expansion and Whatsapp monetisation. Watch for Llama 5’s performance to track ROI on spending: latency & leaderboards

![Meta Advantage+ Guide [2025]: Features, Tools, Optimization Meta Advantage+ Guide [2025]: Features, Tools, Optimization](https://substackcdn.com/image/fetch/$s_!Am9x!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F50888a47-1016-4190-a793-bc5ca9eb8e84_4000x2250.png)

Interesting take on the Gemini ad tier potentialy impacting margins. The SpaceX IPO effect on Alphabet's EPS is something I hadnt considered before, and that could definitly provide a nice boost. I've been following the AI ad integration space closley and the margin dilution concern feels valid shortterm. Your balanced approach here between upside and downside scenarios is refreshing compared to most bullish takes out there.

Hey, great read as alays. Im really curious how the reported 10x cost of AI chatbot searches will balance against Gemini ads being margin dilutive but still a positive overall for TAM expansion.